The Cambridge English Dictionary defines a scam as ‘an illegal plan for making money, especially one that involves tricking people’.

Bitcoin is, by popular consensus, a digital asset which operates as a medium of exchange. It utilises the Blockchain technology to achieve this. As such, it is far from the truth to label Bitcoin as a scam itself. On the contrary, many sees Bitcoin as digital gold. Allow time for more mainstream adoption, it can revolutionise the incumbent financial system.

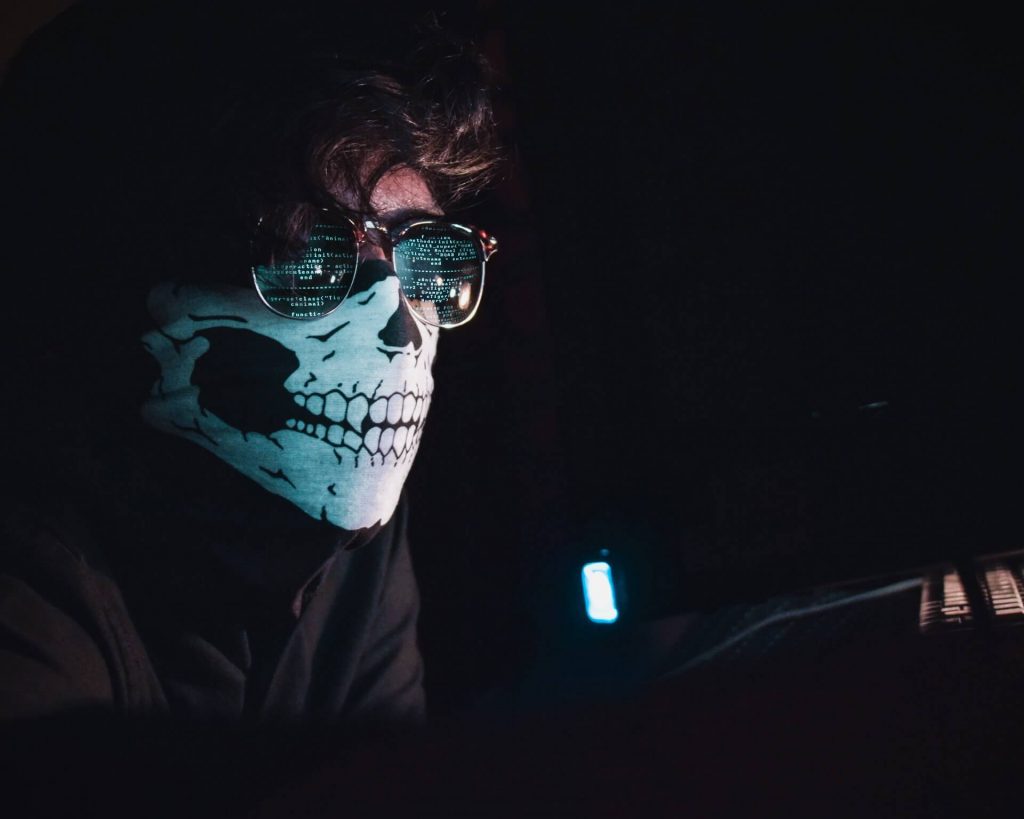

So why is Bitcoin often associated with scams? The reason is simple: like many new ideas and concepts, there are cunning, malicious actors who try to make a quick profit. They do so by targeting the innocent and unsophisticated newcomers.

POPULAR BITCOIN SCAMS AND WAYS TO AVOID THEM

HIGH YIELD INVESTMENT SCHEMES

When someone provides you the promise of doubling your money within 5 days by simply pressing a few buttons, it may sound too good to be true. Guess what? It is.

High yield investment schemes have been around for a long time before the invention of Bitcoin. The creation and popularity of Bitcoin have simply added fuel to the fire. Given the transferability and pseudonymous nature of Bitcoin, it makes such schemes much easier to execute.

Luckily, these schemes are very easy to identify and avoid. Typically, the perpetrators market them very heavily using a lucrative referral system. More often than not, they will generate the promised returns initially. However, when scrutinised further, one can always find a few flaws: 1) there isn’t really a sound business model from one makes sustainable profit; 2) the identities of the founders are generally not visible; 3) the yield or interest rates are abnormally high, typically exceeding 100% per annum; and 4) there is a ‘hype’ and ‘frenzy’ around it all.

HOW TO AVOID THIS SCAM?

If one does their research thoroughly, they should rarely (if ever) fall victim to these schemes.

MAN IN THE MIDDLE SCAMS

This scam involves three parties, the scammer, the victim, and the Bitcoin seller. However, it is common practice that only the scammer is in contact with the victim. We have encountered a number of real-life examples of this happening. We are going to share below in order to better expose the scam.

The victim has contacted the scammer regarding an advertisement which claims there is a puppy that is available for adoption. Everything about the advertisement looks legitimate, except for the fact that the puppy is located overseas. A $500 vaccination fee is required in order to bring the puppy into the country. The victim is more than happy to pay the vaccination fee as they have fallen in love with the cute puppy!

Unknowing to the victim, the scammer is also talking to a Bitcoin seller in order to purchase $500 worth of Bitcoin. Everything seems to check out for the Bitcoin seller who happily provides their bank details to the scammer.

Upon obtaining the bank details, the scammer then passes on the details to the victim who gladly deposits the $500 into the account. He or she thinks it is payment for the vaccination fee. Upon receiving the money, the Bitcoin seller releases the Bitcoin to the scammer, who then disappears. This leaves the victim out of pocket and puppy-less.

If you think that the story above is cunning and scary, the real-life example goes a few steps further. The scammer actually doesn’t stop there. The scammer then makes further contact to the victim requesting payment for a ‘level 2’ quarantine fee, a larger amount than initially requested. This trend continues until the victim finally realises that it is a scam or simply runs out of money.

HOW TO AVOID THE SCAM?

1) Be sure to verify that the identity of the person that you are talking to online matches their profile.

2) If they claim to be ‘X’ but want you to deposit money into someone else’s bank account, that is usually not a good sign.

3) Be sure to read all email correspondences and other messages carefully.

4) Furthermore, calling the other party if possible is very important. Although some scammers are fluent in English, it is a second language to a lot of them and there can be obvious grammatical mistakes.

5) Lastly, don’t be greedy! When something seems too good to be true, it generally is.

NIGERIAN PRINCE

The Nigerian prince scam, similar to high yield investment schemes, has been around for a long time. Bitcoin is not the cause of the scam but is used (only recently) to make the scam more feasible for the perpetrators.

For those who are not familiar with the scam, here is the deal. It typically involves a polished, handsome young man who develops a romantic relationship with the unsuspecting victim. The scammer normally looks for his prey through online chatrooms or dating sites. In addition to being young and handsome, this person also poses as a member of a high-profile family, e.g. a prince. The victim then falls in love with this prince and quickly the romantic relationship develops into promises of marriage.

However, it is not long before the prince contacts the victim claiming that he is in a foreign country and he needs some money desperately. The reason behind the sudden need for money can vary. It typically relates to a troubling situation, a bad injury, or a situation where he is chasing a large sum of money, e.g. an inheritance. However, he requires some upfront cash to unlock it, e.g. an administration fee. The only catch is that the payment must be via Bitcoin given that the banking system in a foreign country isn’t reliable.

At this stage, the victim is 100% confident that they have found their true love. They then buy the Bitcoin with no hesitation whatsoever and sends it across. It is then obvious what happens from there.

HOW TO AVOID THIS SCAM?

Make sure you meet your prince in person before trusting him, especially when money is involved, no matter how convenient his excuses are.

MONEY MULE

Money laundering has been in existence for years, and the mastermind behind it all often needs ‘mules’ to place the money into the financial system.

It is widely known that Bitcoin has been used to facilitate money laundering activities. A typical process involves the following steps:

1) Person A wants to launder their illicit cash proceeds into the financial system so that they can buy a luxury apartment.

2) He/she then finds Mule B, Mule C, and Mule D and gives them $100k each to deposit into their bank accounts.

3) In the meantime, Person A locates a Bitcoin dealer. He/she instructs Mule B, Mule C, and Mule D to open accounts with this Bitcoin dealer and purchase Bitcoin from them.

4) Mule B, C, and D then send the Bitcoin into a wallet address as instructed by Person A. Person A then use a digital currency exchange in a country that has low requirements regarding anti-money laundering laws, to ‘cash out’ on the Bitcoin.

5) The illicit cash proceeds are now part of the financial system and Person A describes it as returns on investments. Person A can then use this money to buy luxury goods.

HOW TO AVOID THIS SCAM?

Always be wary when strangers approach you to deposit money and/or forward money, especially if they ask you to convert them into Bitcoin. These are typical signs of a money laundering network attempting to recruit a ‘money mule’.

THESE ARE NOT TECHNICALLY SCAMS BUT NOT RECOMMENDED FOR BEGINNERS:

1) Initial Coin Offerings: stay clear unless you are very confident about the project. This is extremely high risk and you can expect to lose all of your invested capital.

2) Margin trading for digital currency: once again, extremely high risk and known to be subject to price manipulation.

3) Alternative coins: many alternatives to Bitcoin are far less secure and much riskier.

4) Online digital currency wallets: it is always recommended that each user should have their own hardware wallet. There are many online digital currency wallets that turn out to be scams and the coins disappear with the platform.

5) Other novelties such as crypto ‘collectables’: novel ideas may sound fun and all, but they can turn very ugly when money and greed are involved.

Source: CoinStash