In our previous article, The big crypto rush – a few words about risk, we discussed the concept of volatility and risk for all securities, including for cryptocurrencies, and we looked at how to assess the overall portfolio risk.

What many crypto investors want to know is, what percentage of their investment portfolio should be invested in crypto?

The equivalent question to that is: How much can you tolerate to lose?

Advisors from around the globe suggest different percentages of investments in cryptocurrency to investors.

We argue that there is no percentage that works for everyone, because each investor is different and so is their portfolio.

If we look at this question from an investor’s perspective, we need first to consider: what are the goals of the investor, to accumulate wealth, buy a house, pay off a debt, retire safely etc.? All investments carry risks, so it’s imperative for any investor to first understand and map out their goals when it comes to investing and understand what their individual risk tolerance level is.

At the end of the day, what everyone wants is to get a good return while taking low or no risks. Almost impossible, one would say. But technology shows us that it is possible to at least consider thousands of scenarios at once and choose the one that gives you the best possible return for the lowest possible level of risk.

Let’s look at an example:

We consider the same example we had in the previous article, that is, a portfolio of 6 investments (5 ASX stocks making up 90% of the portfolio and 1 cryptocurrency for the remaining 10%) as follows: CBA 20%, MAQ 20%, COL 20%, BHP 20%, WES 10% and BTC 10%.

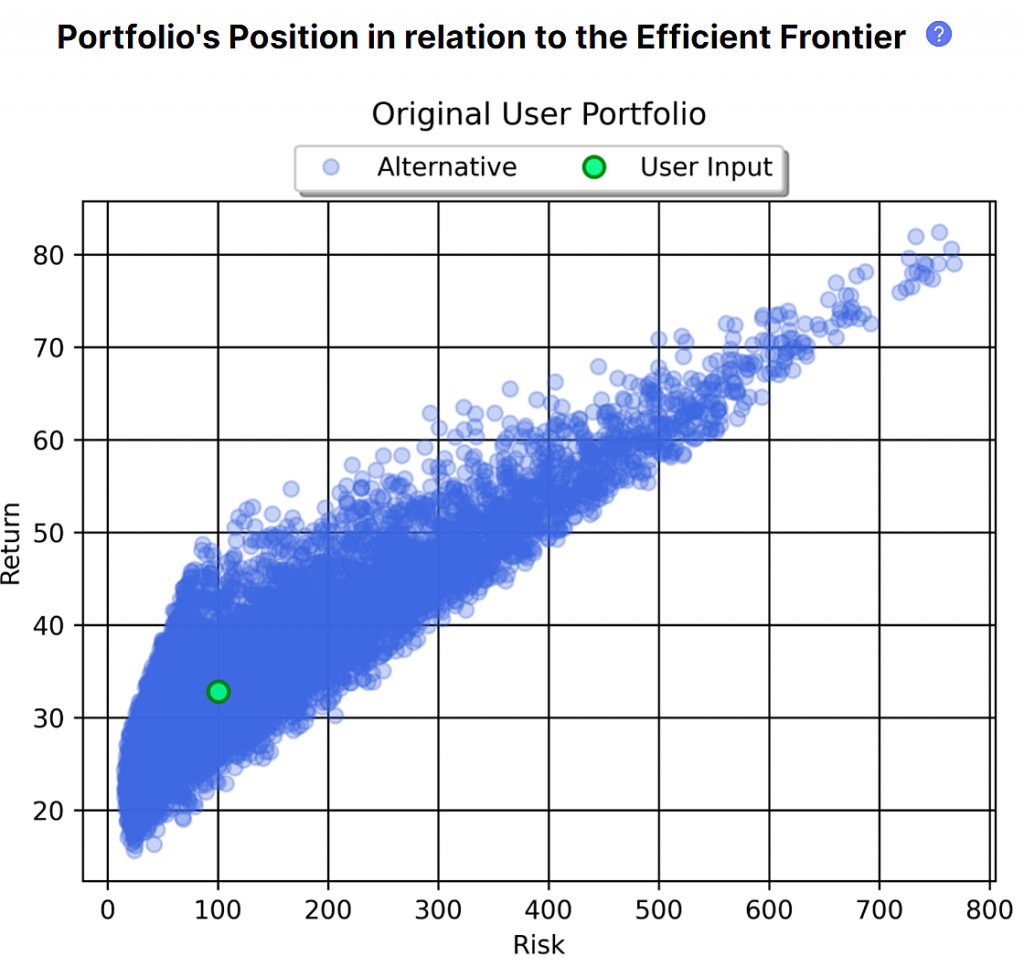

If we run this portfolio in Diversiview, we get a 32% portfolio return and 100% risk, which places the portfolio somewhere in the middle of over 5000 other possibilities of combining the same securities (see Fig 1).

Fig1 Weight allocation for a random allocation in the example portfolio

As it can be seen, for a risk (volatility) of 100%, there are other, better positions that would give an expected return of 50% or so. Also, there are positions on the curve at the left that can achieve a return higher than 32% for a risk less than 100% – even better!

So, one question to answer is, how can we find the percentage of Bitcoin in this example that can give us the lowest risk?

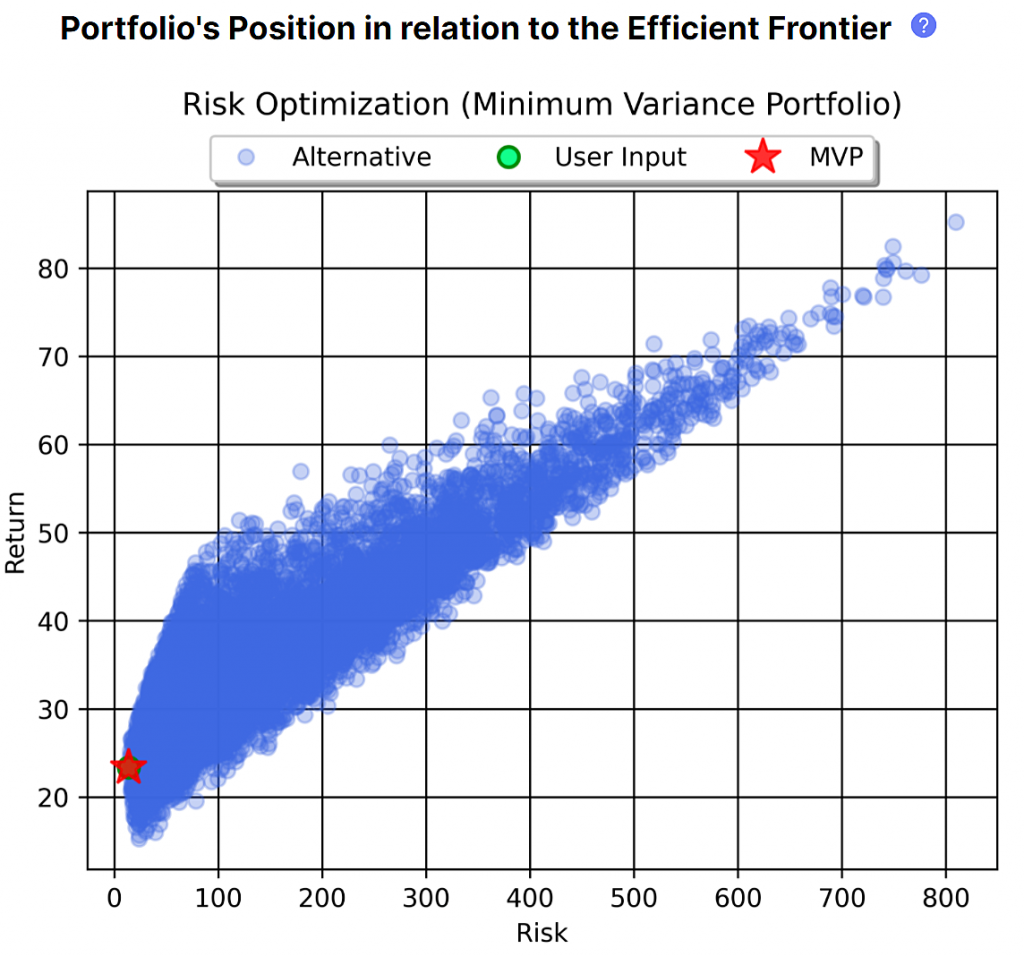

To do this we can employ Diversiview Balancer and obtain the following allocation: CBA 10.81%, MAQ 1%, COL 3.88%, BHP 77.05%, WES 6.26% and BTC 1%. By reducing Bitcoin allocation to 1% and adjusting the other securities as well, we can obtain an expected return of 23% and a volatility of approx. 14%. While the return is reduced by 9%, the risk is also reduced dramatically by 86%.

The new portfolio position is the one at the most left position in the universe of possibilities, i.e. the one with the lowest risk (see Fig2).

Fig2 Weight allocation for minimum risk in the example portfolio

As it can be noticed from this example, the actual percentage (allocation) that someone may want to invest in a particular security, including in crypto, is not at all definable and static.

It will very much depend on the outcome you try to achieve – in this example 1% Bitcoin was required in order to find a portfolio position that has the minimum possible risk for the set of securities selected.

*Note: this is an example only, it should not be relied upon to make any investment decisions. Please consult with your financial advisor before making any changes to your portfolio.

To sum it all up in a nutshell, we would like to ask investors, three simple questions:

- Do you know the risk and expected return of your current portfolio?

- Where do you stand compared to many other possible potential risk & return positions for the same set of securities?

- Are you happy with the position you’ve got, or you need to minimize your risk, maximise your return, or both?

Based on the above answers, you can easily adjust your portfolio and reassess it. The most important thing is that you are happy with the level of risk you take, for then return you expect.

If you are an active investor who is looking to optimise your portfolio, you may want to check out Diversiview as it’s the single application that can help you answer the questions above – whether you invest in cryptocurrencies, ASX listed securities or a mix of everything.

About the author:

Dr Laura Rusu is the Founder and CEO of LENSELL®, a Melbourne based Fintech that aims to democratise access to financial and non-financial corporate performance information, and help people make better decisions with data driven insights.

Diversiview® by LENSELL brings data science to Australian retail investors and allows them to design and validate diversified investment portfolios to suit their own risk and return expectations. All ASX listed investments (stocks, ETFs, bonds) and the top 15 cryptocurrencies can be included in the portfolio analyses.